THE FREE, SAFE, AND EASY WAY TO BUILD CREDIT FOR TEENS

With Step, everyone can earn 3.00% on their savings̾, build positive credit history ̍, and enjoy cashback˖˖ together.

Credit

Learn how you can help your kids and teens build their credit history early

Savings

Learn how your family can earn 3.00% on your savings

Security

Learn about Step's security features to keep everyone safe

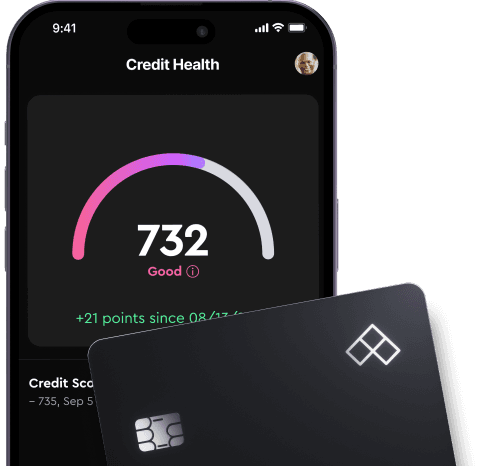

Step users have an average initial credit score of 721

֠

START THEIR CREDIT JOURNEY EARLY

Step is the best way for your child to build a positive credit history before they turn 18, without the risk of overspending or missing payments.

| Very Poor 300-600 | |

|---|---|---|

Car Insurance Learn More | $147/mo | $250/mo |

Student Loan Rates Learn More | 6.24% | 10.46% |

Security Deposit Learn More | 6.24% | 10.46% |

TransUnion Research ֕

TransUnion Research ֕

Get them on track to good credit even before they turn 18

They use their card and can’t overspend

Purchases build positive credit history

Start reporting their credit history at 18

Safe and secure

Step empowers you to block merchants, freeze cards, and monitor spend. The Step Card is covered by Visa’s Zero Liability Protection Policy** and FDIC-insured up to $1,000,000.***

Mission: Improve the financial future of the next generation

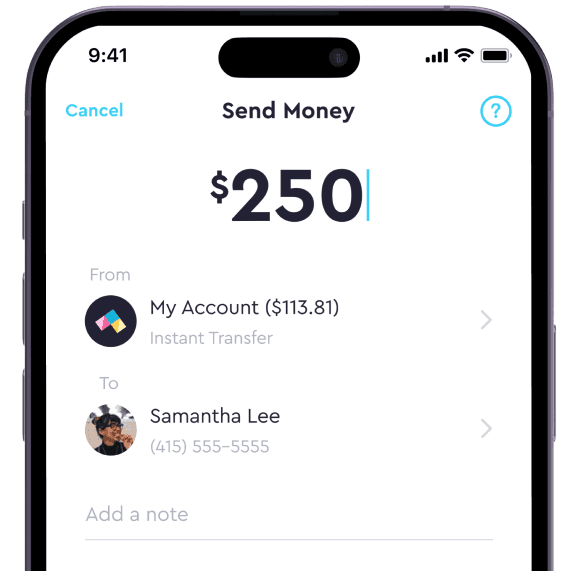

Easily send and receive money

Instantly add money to their account, automate their allowance, track their balance, and give them control of their paycheck with direct deposit.

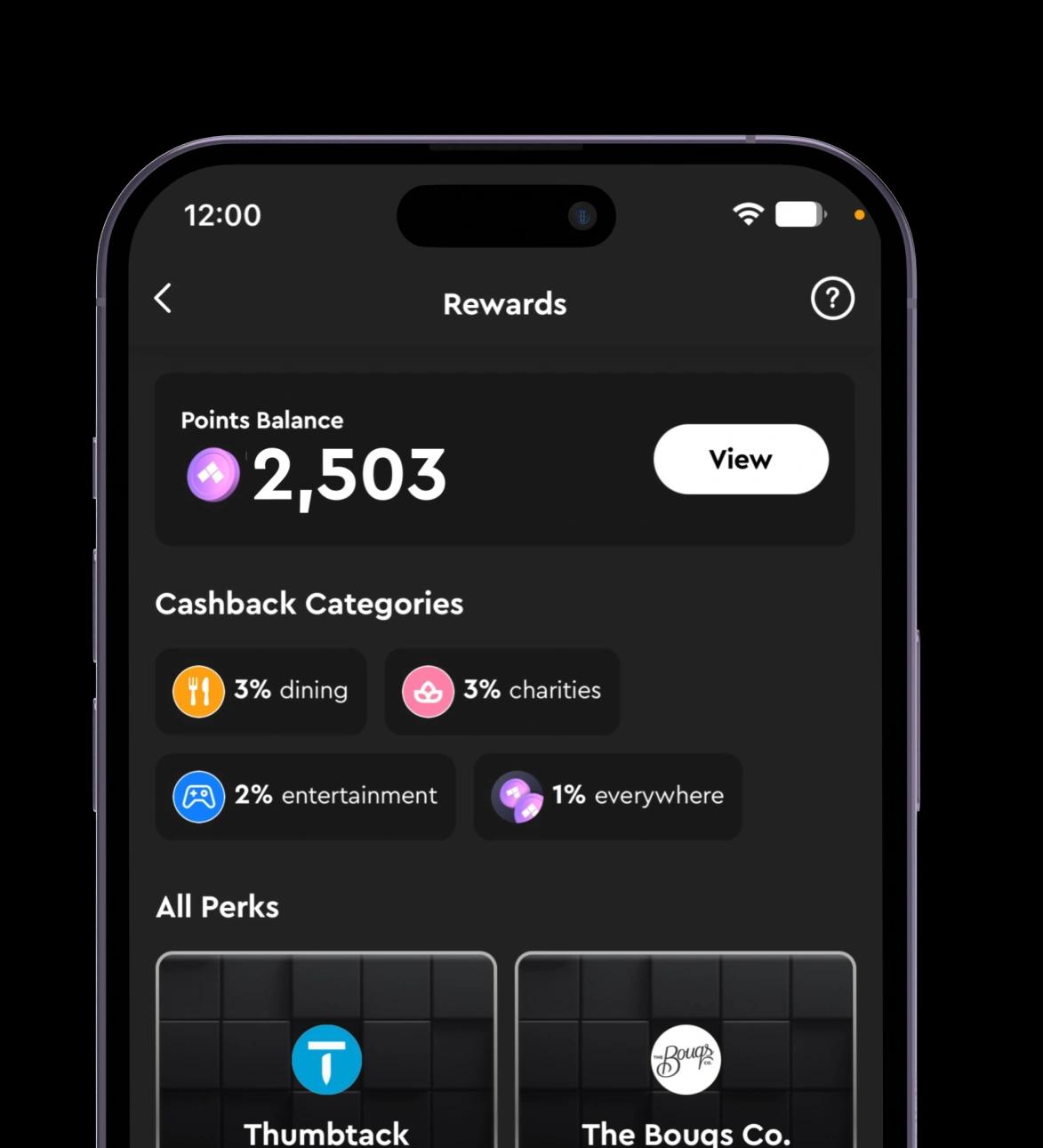

Rewards for healthy habits

The entire family can enjoy up to 10% cashback from select merchants, 1% everywhere else, and $500 in annual credits͑ to help you get more for less.