A Beginner’s Guide to Budgeting: How to Get Started

Ready to learn how to manage your finances without the headaches? You've come to the right place. Let’s break it down step-by-step so you can feel confident about your money and make the most of every dollar.

Step 1: Understand Your Monthly Fixed Costs 💸

The first step to budgeting is knowing exactly what amount you need to cover your essential expenses. This amount is called your monthly fixed costs and includes things like your rent, utilities, groceries, and other mandatory bills—essentially, the costs that keep your life running smoothly.

Start by listing all your recurring expenses. For costs that vary each month, like gas or groceries, calculate your average spending over the last three months. Don’t forget to include subscription services like Netflix or Amazon Prime—calculate their monthly cost if billed annually!

Once you have a total, add a buffer of about 15% to cover unexpected expenses, like a surprise phone repair or an extra bill. This will give you a solid foundation for understanding your basic expenses. Feel free to download this chart to help you get started!

Step 2: Set Up Your Account Framework 🏦

Next, let’s set up a system to manage your money effectively. Start by using the 50/30/20 rule:

50% for Needs: Covers your fixed expenses—rent, bills, groceries.

30% for Wants: Think fun things like eating out, shopping, or going to concerts. Budgeting doesn’t mean you can't enjoy your money!

20% for Savings and Investments: This portion goes toward building an emergency fund or saving for a big goal, like a trip.

The 50/30/20 rule is a great starting point. As you learn more about your spending habits, feel free to adjust it to better fit your goals. The key is to be intentional with how you allocate your money.

Step 3: Build Your Savings Plan 💰

Start by building an emergency fund. Aim for 3-6 months' worth of expenses, depending on what makes you feel secure. This fund is for unexpected life events—car repairs, medical bills, etc.—without resorting to debt.

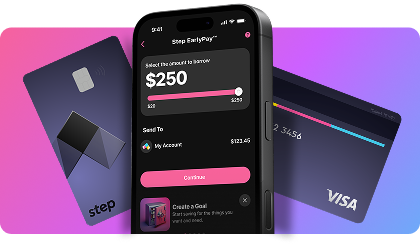

Once your emergency fund is fully funded, you can set aside money for other goals. Want to travel? Buy a new laptop? Create separate Savings Goals on Step to stay organized and avoid spending on non-essentials. Keeping your savings organized will help you track progress and stay motivated.

Make sure to put your savings in the right place. A high-yield savings account (HYSA) or something like Step's Saving Goals can help you earn more compared to a regular bank account. For instance, saving $10,000 in a HYSA with a 4% annual return earns you about an extra $400 by the end of the year—this is much better than just letting it sit in a low-interest checking account!

Step 4: Stick to It—And Adjust as You Go! 🚀

Budgeting is about understanding, adjusting, and finding what works for you. Start with the steps above, but keep fine-tuning your system as your lifestyle changes. Maybe you’ll find that 30% for wants is too high, or you need a bit more for savings—that’s okay. The goal is to stay flexible and adapt your budget as your needs evolve.

Take Control of Your Money Now! 🛠️

Now that you've got the basics down, it's time to put them into action! Want to learn more? Check out Money 101, Step's 6-part financial literacy program, or visit our YouTube channel for videos about money and personal finance.

Want to take it a step further? Check out Step Black to save more and earn rewards on your spending. Budgeting is all about freedom—know where your money is going so you can do more of what you love. You’ve got this! 🎉