Get an Advance on Your Paycheck? Here’s a Smarter Way to Borrow Money

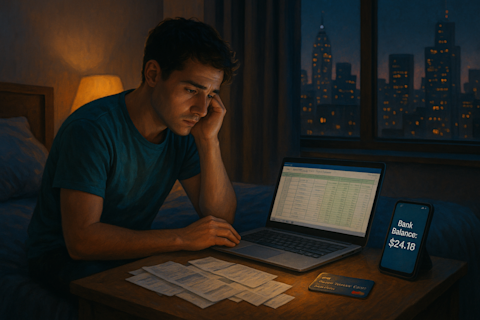

Life hits hard sometimes. You’re coasting through the week when suddenly—boom—your phone screen shatters, your car won’t start, or your rent’s due before your paycheck lands. That’s when the idea to get an advance on your paycheck suddenly sounds pretty appealing.

Traditionally, people relied on their employer to float them some cash. It’s called an advance on paycheck from employer, and yeah—it’s as awkward as it sounds. You’d have to ask your manager, fill out forms, and hope they said yes. Today, there’s a much easier way to get help when you need it—without the weird conversation or the shady payday loan.

Let’s talk about how Step EarlyPay gives you a better option—technically not an advance, but a no-interest installment loan that works even better.

How to Get an Advance on Paycheck (Without the Drama)

Getting an advance used to mean awkwardly asking your boss to front you some cash. But the game has changed. With apps like Step, you can get cash before payday—no questions asked.

So what exactly is a paycheck advance, and how does Step compare? Traditional advances front you money from your paycheck—but Step EarlyPay offers something safer. It’s a small installment loan with no interest, designed to feel just as seamless—without the hidden costs or risks.

Instead of racking up credit card debt or paying payday fees, you get what you need now, and have flexible repayment options and can repay automatically when your paycheck lands or from your Step Account.

And yes, it is possible to get an advance instantly. With Step EarlyPay, if you’re over 18, live in the U.S., and receive at least $500 in direct deposits to your Step account within a 31-day window, you’ll qualify. Once you get your first paycheck, EarlyPay unlocks inside your Step app automatically—no credit check, no paperwork.

The Fastest Way to Get an Advance on Your Paycheck Today

You’ve got options when it comes to paycheck advances—but not all of them are great.

You could go the old-fashioned route and ask your job for an advance (good luck). You could try a payday lender and deal with sky-high interest rates and fees. Or, you could open the Step app and get up to $500 with zero interest and no late fees. Step EarlyPay isn’t a traditional paycheck advance—it’s a no-interest installment loan. But it works similarly by giving you access to money when you need it so you don’t have to wait for payday, without the downsides of a payday lender.

Step lets you choose how much to borrow—anywhere from $20 to $500. If you need the money instantly, you can pay a small 5% fee that’s charged when you repay. If you can wait a few days, it’s totally free.

The repayment process is smooth and automatic. When your paycheck lands, Step deducts what you borrowed. If your deposit is delayed, it’ll pull from your Step balance or any future deposits. No stress, no surprises.

Why EarlyPay is Is Better Than a Traditional Paycheck Advance

There are plenty of apps out there promising fast money—but Step is different. It’s built for people who want speed and control, without falling into a debt trap. With Step EarlyPay, there’s no interest, no hidden fees, and no pressure. You borrow what you need, when you need it, and pay it back automatically. It’s that simple.

And while we’re talking about smart money moves—Step isn’t just an app that works like a paycheck advance. It’s also a credit building app. That means you can borrow money and build a stronger financial future at the same time.

Most young adults don’t realize how much of a difference a good credit score makes until it’s too late. With Step, you can use a credit card to build credit safely—and the average Step user hits a score of 721 by the time they turn 18. That’s miles ahead of most adults.

So if you’re wondering, “How can I borrow money from my paycheck?” or searching for the best app to get an advance on paycheck, this is your answer.

Need $50 Instantly? Here’s the Smart Way to Do It

Sometimes, you just need a small amount—like $50—to cover groceries, gas, or a last-minute bill. With Step EarlyPay, you don’t need to borrow more than you can handle. You can request as little as $20, and get it within seconds if you choose instant delivery.

Compare that to payday loans, which charge insane fees and trap people in debt cycles. Or credit cards, where even a $50 purchase can turn into $75 once interest adds up.

EarlyPay is about keeping it simple, fair, and flexible. Borrow small, repay quickly, and move on with your life.

The Bottom Line: Borrow Smarter with EarlyPay

If you’ve ever wondered, “Can I really borrow money before payday?”—now you know. Not only is it possible, but with Step EarlyPay, it’s finally easy and stress-free.

Forget the payday lenders. Forget the awkward boss chats. EarlyPay gives you up to $500 with no interest, no credit check, and automatic repayment. It’s one of the fastest, safest ways to access your own money—on your terms.

And the best part? Step helps you build credit while you borrow, so every time you use EarlyPay, you’re building a stronger financial future.

Ready to try it out? Set up direct deposit and unlock EarlyPay today. Your future self will thank you. 💪