How do credit scores work?

A credit score is a three-digit number (300–850) that represents your creditworthiness, calculated based on your payment history, credit utilization, and other factors. Lenders use it to decide if you qualify for loans or credit. Let’s break down how credit scores work and why they matter.

The ins and outs of credit

Whether you’re just starting out on your financial journey or have already mastered the basics, understanding what credit is and how to build it is incredibly important.

Your credit score isn't just a number; it's a key that can unlock doors to more accessible housing, car loans, and more. Landlords, banks, and car dealerships will often look at credit scores to determine if they’d like to do business with you. A good credit score not only broadens your adulting horizons but can also save you money through lower rates and monthly payments.

If you're curious about credit scores and eager to learn how to build one, you've landed in the right place. Let's dive into the fundamentals together.

What is a credit score?

A credit score is a three-digit number ranging from 300–850 that represents how likely you are to repay your debts on time. Think of it like your school GPA, but instead of measuring how well you do in your classes, it reflects how well you manage your money. Lenders (like banks and credit card companies) use this score to determine if they want to give you money. Like your GPA, the higher your score, the more opportunities you’ll have.

Types of credit scores & ranges

Now, let’s discuss the different types of credit scores and ranges. Much like with schools — which follow the same general grading principles, but vary slightly based on their individual rubrics — credit scores can differ by credit bureau.

The U.S. has three main credit bureaus: Equifax, Experian and TransUnion. The job of these for-profit agencies is to analyze credit information and pass their findings along to lending institutions and credit issuers to help them make informed loan decisions. The output of their analysis is your credit score.

FICO is one type of credit score that is pretty widely used by lenders. Below is a breakdown of FICO scores by range – reflecting how good or bad you are at managing your money:

Poor: <580

Fair: 580-669

Good: 670-739

Very Good: 740-799

Exceptional: 800+

These ranges are important because the better your score is, the easier it generally is to get approved for a credit card or loan with good rates. Like your GPA, which is a key factor in determining what colleges you can get into, your credit score can hold you back when it comes to getting the best rates for borrowing money. However, unlike your high school GPA once you've graduated, there are always ways to improve your credit score.

How do credit scores work?

Let’s start with credit reports. If your credit score is like your GPA, then your credit report is like your report card - a history of all your borrowing activity, including how much money you’ve borrowed and whether or not you have made timely payments. Together, all of these details make up your credit score.

Divided into five main categories, each category makes up a different percentage of your score:

1. Payment history (35%): This shows how reliably you pay back bills. Late payments will lower your score while on-time payments can boost your score or keep it steady.

Example: Jordan sets up autopay for his monthly Spotify and Netflix subscriptions using his Step Card. Every month, the payments go through automatically and he never misses a due date.

These small, on-time payments help build a strong payment history — the most important factor in a credit score.

Now imagine he skips a payment for a few months. That missed payment could stay on his report for years and lower his score significantly.

2. Credit utilization (30%): This is the ratio of how much debt versus credit you have available. For example, if your credit card limit is $1,000 and your current balance is $100 (i.e., your debt) then your credit utilization is 10%. The rule of thumb is to keep your total credit utilization under 30%.

Example: Maya has a Step Card with a $500 limit. She uses her card to buy $150 worth of clothes online. That’s 30% of her credit limit — which is a good number to stay under.

But when she adds $200 of food delivery charges the next week, her total balance jumps to $350 — now she’s using 70% of her limit. If she doesn’t pay it down soon, her credit utilization ratio will be high, which can hurt her score.

3. Credit history (15%): This represents the average age of your credit life – determined by the average of the total length of time each credit account has been open. In this case, you want to have older accounts in good standing, demonstrating a long history of successfully paying your debts.

Example: Ava opened her Step Card when she turned 18. She’s been using it responsibly for over a year now — buying essentials and letting Smart Pay pay off her balance automatically every month.

Because she’s kept the same account open and in good standing, her credit history is growing longer, which improves her credit score.

If she were to close her account too soon or switch to a new card, her average account age could drop — which may negatively impact her score.

4. Credit mix (10%): This is the combination of debt types you have such as credit cards, student loans and car payments. It’s good to have a mixture of debt types but you don’t need one of every kind.

Example: Lily has a credit card and a small student loan. This shows she can handle different types of credit — a credit mix — which can improve her score.

But if she only has one card and never tries other forms of credit down the line, her score might grow slower than someone with more variety.

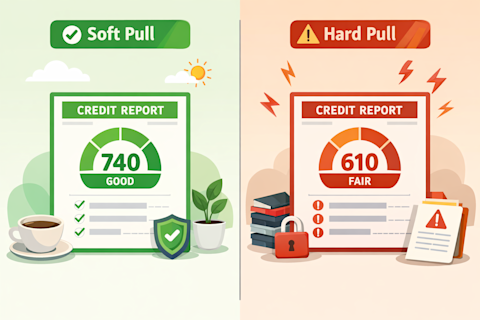

5. New credit (10%): This is defined as any new type of debt (credit cards or loans) added to your credit report in the last six to 12 months. While it’s good to establish additional credit, opening or applying for too many new accounts in a short period of time can hurt your score.

Example: Dylan just turned 18 and was excited to get his first credit card. Within a week, he applied for three different store cards to get quick discounts while shopping.

Each of those applications triggered a hard inquiry on his credit report. Too many new credit applications in a short time can make him look risky to lenders — even if he’s approved.

If Dylan had waited a few months between applications, his score might have stayed more stable.

How Step can help you build credit

Start building credit history early

Historically, there have been very few ways to build credit history before you turn 18 since you can’t legally apply for a loan or credit card in your name until you turn 18. Step changes that by offering a credit building app that allows you to do just that.

Unlike other banking products, Step allows you to start building a positive credit history before you turn 18 while removing the risks associated with more traditional cards such as late fees, incurring debt, and interest charges.¹

All you have to do is make purchases with your Step Visa Card! Let’s say you have $500 in your Step Account and you buy a $50 pair of Crocs with your Step Visa Card. When you make a transaction:

Step secures an amount equal to your purchase ($50.00) from your deposit account so you now see a balance of $450.00 in your app.

With Smart Pay, your $50.00 purchase is automatically paid off at the end of the month using the funds we secured.

Since your bill was paid on time (thanks to Smart Pay), you build a positive payment history – which you need to have a good credit score!

Avoid overspending and missed payments

When you open a Step account, you get a Step Visa Card that is linked directly to your account. Similar to a debit card, you can only spend up to the amount of money that’s in your spending account by default. This means you don’t have to worry about overspending.

Your Step Visa Card also comes with a feature called Smart Pay. With Smart Pay, your purchases are automatically paid off at the end of every month using the funds in your spending account. Think of Smart Pay as an autopay feature. Step also keeps track of this positive payment behavior and gives you the option to start reporting it to the credit bureaus once you turn 18.

The bottom line

Good credit scores can open doors and save you money through lower interest rates and premiums. Step is a secured Visa card that helps you build positive credit history even before you turn 18, allowing you to get a head start on establishing a good credit score.

If you're looking for an option to start your journey, credit cards for building credit are a great way to get started on the right foot. Download Step Credit Building App from Google Play and take control of your financial future today.