How to Get Small Cash Advance Loans Without High Fees

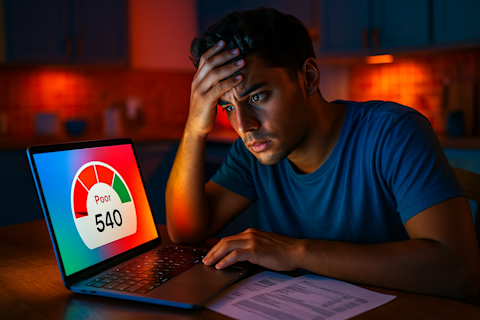

Life happens fast. One day everything’s fine, the next your car won’t start or your phone gets fried. In moments like these, having access to a small cash advance can help you stay afloat until your next paycheck.

But here’s the problem: most short-term borrowing options come with sky-high fees, outrageous interest rates, and confusing terms that trap you in debt. What starts as $100 can snowball into hundreds more if you’re not careful.

That’s where Step’s EarlyPay feature comes in. It’s a smarter, safer way to access quick cash—without the stress, and without predatory terms.

Small Cash Advance Loans Without High Fees – Your Best Options

What Are Small Cash Advance Loans & How Do They Work?

Small cash advance loans are short-term loans—typically between $50 and $500—meant to help cover unexpected or emergency expenses. People use them for things like rent, groceries, car repairs, or medical bills when payday is still a few days away.

But while the amounts are small, the costs often aren’t. According to the Consumer Financial Protection Bureau, payday loans frequently carry APRs over 300%, making them a risky solution to short-term cash flow problems.

Why Traditional Cash Advances Are Expensive

Here’s what makes many payday loans or cash advances so costly:

Flat fees just to access funds

Sky-high APRs (300%+ is not uncommon)

Rollover traps where unpaid loans are extended with new fees

Aggressive repayment terms that can lead to overdraft or late charges

These features make it easy to fall into a cycle of borrowing that’s hard to break.

A Better Alternative

Step EarlyPay gives eligible users access to up to $500 with:

No interest

No hidden fees

Automatic repayment from your next paycheck or Step account balance

You choose how much to borrow—from $20 to $500—and repayment is handled automatically. It’s short-term borrowing made simple, transparent, and low-cost.

How to Get an Instant Small Cash Loan Without High Fees

How It Works

More than half of Americans live paycheck to paycheck, and over a third have less than $1,000 in savings. Even a small emergency can cause a major financial setback. EarlyPay offers a simple, stress-free way to handle these moments.

To unlock it, you must:

Be at least 18 years old

Live in the U.S.

Have received at least $500 in direct deposits to your Step account within a 31-day period

Receive at least one paycheck into your Step account

Once you meet those criteria, the option to access Step EarlyPay will automatically appear in your app.

To borrow:

Open the app and tap EarlyPay

Choose an amount from $20 to $500

Select your delivery method:

Instant: Funds arrive in seconds with a 5.5% fee (charged at repayment)

Standard: Funds arrive in 1–3 business days with no fee

Repayment is automatically deducted from your next paycheck or from your Step account balance if needed. There are no late fees, no interest, and no manual steps.

Where to Find Quick Small Cash Loans Online

Online Lenders vs. Financial Apps – Which Is Better?

If you search for “quick small cash loans online,” you’ll find dozens of payday lenders. While many advertise fast access, most come with high interest rates, strict repayment windows, and fine print that’s easy to miss.

In contrast, Step offers a straightforward borrowing experience. Once eligible, you can get paid before payday by accessing funds within seconds or a few days—without interest, and without falling into a debt trap. It's faster, safer, and easier to manage.

How to Apply for a Small Cash Loan With Minimal Fees

Getting Started

The process is simple:

Download the Step app

Set up direct deposit

Wait for your first paycheck to land

Once eligible, access EarlyPay from the app

Choose your amount and delivery speed

Everything happens inside the app, and repayment is taken care of automatically when your paycheck arrives—or from your balance if needed.

Why It’s a Smarter Option

Unlike traditional lenders, Step doesn’t rely on interest, rollovers, or late fees.

Instead, it offers:

A clear and optional 5.5% fee (only for instant transfers)

No surprises or hidden terms

Automatic repayment, so you never miss a deadline

A more supportive, user-first experience

When to Use Emergency Small Cash Loans

EarlyPay is built for moments when timing—not planning—is the issue. It’s a great option for:

Medical expenses that can’t wait

Urgent car repairs that affect your ability to work or get to school

Groceries or bills before payday when your budget gets squeezed

Example: Say your car breaks down and you need $150 for a tow. Instead of waiting days or taking out a high-interest loan, you use Step EarlyPay to get the funds instantly—and repay automatically with your next paycheck. No stress. No ballooning debt.

Get Small Cash Advance Loans the Smart Way 🧠

If you’re facing an unexpected expense and need cash fast, you don’t need to rely on payday loans or high-interest lenders. The Step EarlyPay feature in the Step app offers a simple, affordable way to cover short-term gaps without putting your finances at risk.

With no interest, no late fees, and clear repayment, it’s one of the best ways to handle short-term borrowing.

Need quick cash without the hidden costs? Try Step EarlyPay today and stay financially stress-free.