Why You Should Set Up Automated Allowances ASAP

Ever get tired of hearing: “Hey mom, can I get $10 bucks for lunch today?” or “Hey dad, can you spot me some cash for the mall?” You’re not alone. In fact, 86% of teens ask their parents for money at least once a month. So, to all the parents out there: we hear you, we see you and we have a new feature built specifically for you!

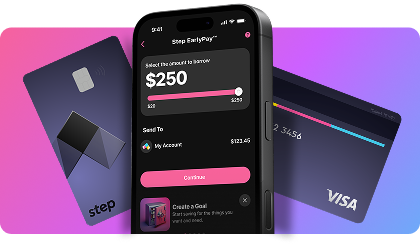

With Step’s new and improved allowance feature, in just a few taps, you can put your teen’s chore money on autopilot and skip or adjust it at any time in an instant. Not only can you ditch the “Hey mom and dad” questions, but it’s also a great way to help teach your teen how to budget.

Wondering how you can start using this feature asap? We got you. Below we’re going to talk about how to turn this feature on, why we love it and know you will too!

Bringing the “Bank of Mom & Dad” into the 21st century

First things first, to turn on this feature, simply follow these 3 steps:

Select the teen account you’d like to set up a payment for (we know some of you have multiple teens on the Step App).

Tap “Recurring payments” and customize the amount and frequency at which you’d like this allowance money distributed.

And finally, don’t forget to tap “Save” so your preferences can be stored within the Step App.

To edit a recurring payment, follow the same steps and make changes to the amount, frequency or add a payment note. You can also toggle the payment on and off from this screen.

Having trouble figuring out how much allowance money to give your teens? Traditionally, experts recommend giving an allowance of $1 to $2 per week for each year in age. So, if your teen is 13-years-old, consider starting them off at $13 per week or $52 per month. And, here’s a little cheat sheet to help you come up with chore ideas appropriate for every age, whether your child is 5 or 15.

Okay, now that we’ve got that squared away, let’s get into all the ways this new feature will change your life!

It gives you flexibility at your fingertips.

Maybe your teen is working really hard and picked up a few extra chores this week that you want to reward them for. Or, on the flip side, maybe they’ve been slacking a bit on their chores. Either way, you can adjust their allowance in an instant, anytime, anywhere.

It teaches your teen how to budget.

By providing your teen with a set allowance schedule, you’re able to start teaching them how to budget by mimicking a paycheck. Consider sitting down with your teen every few weeks to see if they’re staying on track, or if they’re like 65% of Americans, who have no idea where their money goes. The teachable moments here are endless!

It’s one less thing to remember.

Yes, we said it. We know how your lives are as parents, you’re juggling a million different things all at once. Take a few moments to set up and automate those allowances so you can cross something off your to-do list and never have to run to an ATM again! At the end of the day, we know how important your teen’s financial future is and that’s exactly why we built Step. To help you navigate every single personal finance conversation with your teen.

To learn more about our new allowance feature, check out the latest article in our Help Center.