How Many Americans Are Living Paycheck to Paycheck in 2025?

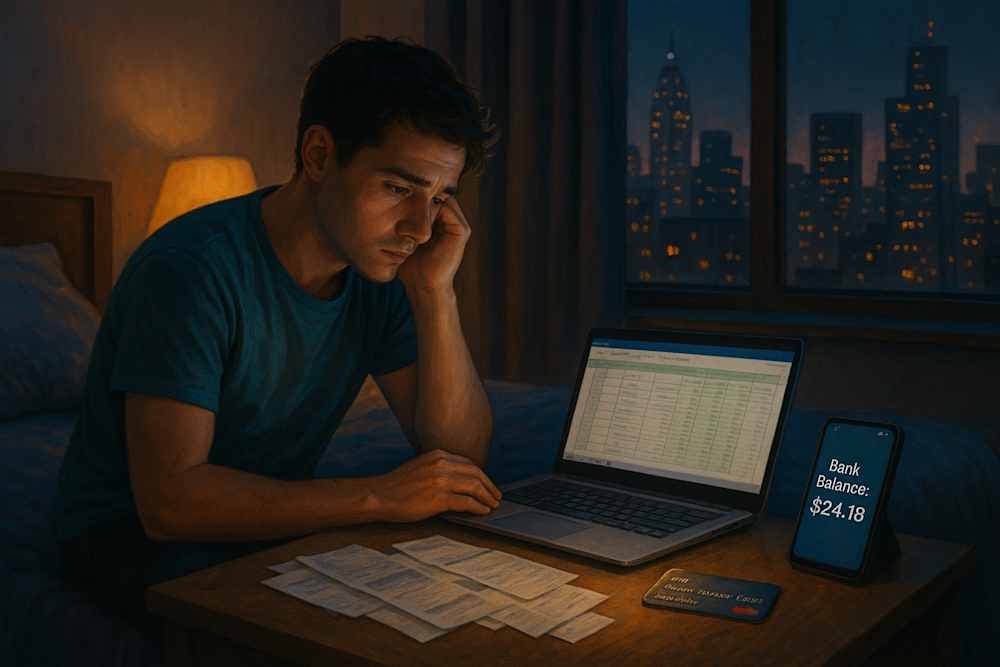

💸 Feeling broke before payday hits? You’re not alone. In 2025, living paycheck to paycheck isn’t rare. For many, it is just how life works right now.

If you’ve ever thought, “Why does it feel like I’m always one unexpected bill away from zero?” this article is for you. We’ll break down how many Americans live paycheck to paycheck in 2025, why it is happening, and what you can do to start getting ahead.

Living Paycheck to Paycheck in 2025

62 percent of Americans report living paycheck to paycheck

73 percent of Gen Z workers are affected

Rising prices, low savings, and flat wages are key drivers

High-interest credit and payday loans often make things worse

Step EarlyPay™ gives eligible users a way to access up to $500 with no interest

You can also build credit and save more easily using tools like Step

How Many Americans Live Paycheck to Paycheck in 2025?

According to a LendingClub and PYMNTS study, about 62 percent of U.S. adults live paycheck to paycheck in 2025. That includes people across all income levels. Even among those earning more than $100,000 a year, 44 percent say they have little or no money left after monthly expenses.

This trend has been building since 2020. Despite some relief from inflation, the cost of living remains high, and wage growth has not kept up.

How Many Gen Z Are Living Paycheck to Paycheck?

Gen Z, those between the ages of 18 and 27, are feeling this the most.

A Deloitte survey reports that 73 percent of Gen Z workers live paycheck to paycheck. That includes people working full-time, part-time, freelance, or service jobs. With rent, groceries, and transportation more expensive than ever, and student loan payments now back, many young adults are earning just enough to get by.

Why So Many Americans Struggle Between Paychecks

Living this way is not about making bad choices. It is about facing real financial pressure.

Prices for essentials have gone up significantly. Between 2020 and 2024, food prices rose by 25 percent, and rent jumped more than 20 percent in many cities according to the Bureau of Labor Statistics. Wages have not kept up. While job markets have recovered, income growth has lagged behind rising costs.

Savings are low. The Federal Reserve found that 37 percent of Americans could not cover a $400 emergency expense without borrowing or selling something.

To bridge the gap, many rely on credit cards, overdrafts, or payday loans. These solutions often lead to more financial stress, not less.

The Hidden Cost of Payday Loans and Credit Card Debt

When money is tight, quick fixes can seem helpful, but they often come with long-term costs.

Payday loans usually come with steep fees and extremely high annual percentage rates. The Consumer Financial Protection Bureau reports that some payday loan APRs exceed 400 percent. Credit cards are more accessible but still risky. The average APR in 2025 is over 22 percent. If you carry a balance, interest adds up quickly and missed payments can lower your credit score. Understanding how credit scores work is a simple way to avoid traps and take more control of your money.

How Step EarlyPay™ Works

If you need help covering expenses before payday, one option is Step EarlyPay™. It is a feature that allows eligible users to access up to $500 in advance with no interest and no credit check.

To qualify, you must be at least 18 years old, live in the U.S., and receive at least $500 in direct deposits to your Step account over a 31-day period. Once you are eligible and receive your first paycheck, EarlyPay becomes available in the Step app.

You can choose standard delivery, which takes a few days and is free, or instant delivery for a small 5.5 percent fee charged only when the money is repaid. Repayment is automatic and happens when your next paycheck lands in your Step account or from any available Step balance. There are no late fees and no interest.

It is a simple, flexible option designed to help you cover short-term needs without taking on long-term debt.

How to Start Breaking the Cycle

You do not need to fix everything at once. Small steps can add up to big progress. Start by tracking your spending. You might find subscriptions or habits that can be adjusted. Automate your savings. Tools like Step’s Round-Up feature save your spare change automatically and help you build a safety net over time.

Build your credit early. A secured credit card to build credit can help you qualify for better interest rates and more options later in life.

You Are Not Alone—and You Have Options

More than half of the country is living paycheck to paycheck in 2025. It is frustrating, but you can make a change.

With better tools and a little planning, you can reduce stress, borrow smarter, and start saving—even if it is just a little at a time.

👉 Download Step to explore EarlyPay™, build your credit, and take back control of your money without falling into debt traps.