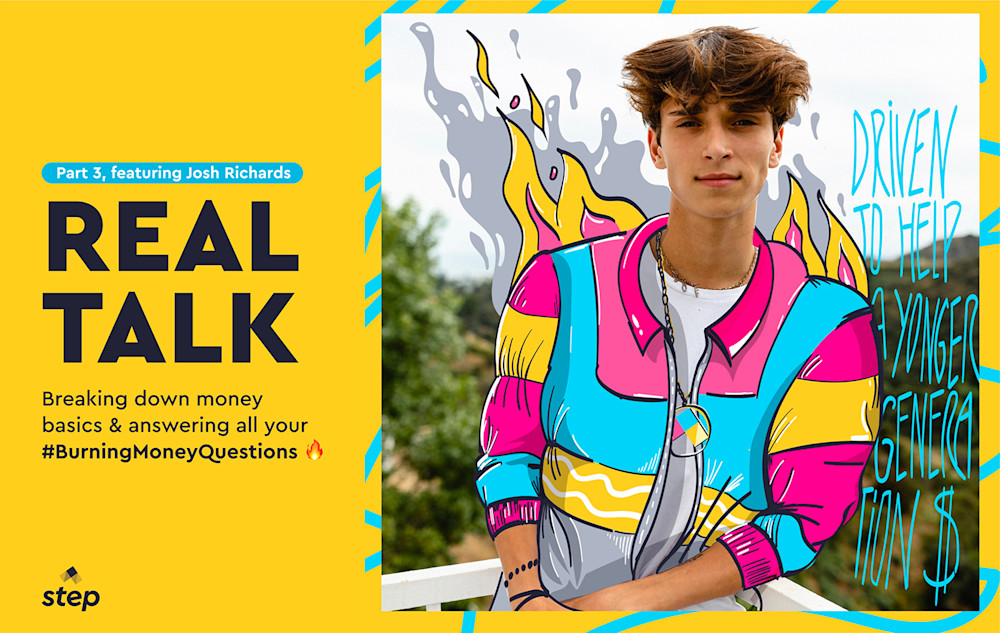

Real Talk: Part 3, featuring Josh Richards

Breaking down money basics & answering all your #BurningMoneyQuestions

And we’re back! With spring just around the corner and snow finally starting to thaw, what better than to talk about all the ideas you’ve been dreaming up during the past few months spent indoors (looking at you, East Coast friends!).

In fact, 41% of teens say they hope to start their own businesses. That’s why this month’s Real Talk is all about entrepreneurship!

We recently sat down with 19-year-old digital megastar and serial entrepreneur, Josh Richards, to discuss his financial journey, advice for aspiring entrepreneurs and why he decided to partner with Step.

Tell us about your own financial journey. When did you first start learning about money and where were you getting your information? 🧭

I actually started learning about money when I was pretty young because I had a number of side hustles –– like a hockey t-shirt company –– and needed to figure out how to keep my overhead costs low enough to turn a profit. As I’ve gotten older and my businesses have evolved, I’ve started to deeply immerse myself in the world of personal finance. Additionally, working alongside many notable entrepreneurs and investors has definitely helped guide me down the right financial path.

What’s the biggest mistake you’ve made with money and what did you learn from the experience? 🤦

At 19, I consider myself very lucky to have avoided making any big mistakes with money. Even though I’m in the public eye, I’m really not much of a spender.

However, when I came off my social media tour in 2019, I decided to treat myself at Louis Vuitton and have regretted it ever since. At the end of the day, I’m more of a t-shirt and jeans type of guy. Instead of purchasing something flashy, I could have spent that money investing in my future self.

What’s one piece of advice you’d like to share with aspiring creators and entrepreneurs? 🤔

First, it’s never too early to start investing. Today, there are so many great digital banking products that will let you start small –– investing $5 or $10 at a time –– so you can begin growing your wealth now, instead of waiting until you’re older.

Second, always ask for equity. This is something many celebrities have shared regrets about - having spent years working for a tv franchise or promoting a product line without having an ownership stake. Essentially, making a flat rate despite their level of contribution to the show or product’s ultimate success.

You recently joined the #StepFam as a partner and investor. What excited you most about the opportunity to work with the Step team? 💙💗💛

I was very fortunate to have mentors who helped me learn about money management and ensured I was making smart financial decisions. But, that’s not the case for most teens. I wanted to pay it forward by using my platform to help younger generations gain a better understanding of personal finances. It’s a core part of my mission and I’m proud to be partnering with Step to help get the message out there!

What’s one burning money question you have?🔥

What more should I be doing to grow my wealth? To answer Josh’s question, there are a lot of small and relatively easy strategies you can implement to help grow your wealth. For example, keeping a close eye on your finances and looking for creative ways to save money will pay dividends in the future.

Similarly, establishing and building up your credit score now will help you attain a higher credit score when you turn 18 - saving you money when it comes time to buy a car or rent your first apartment. Get the Step Card today and your future self will thank you!

Stay tuned as another famous face will be joining us next month to spill all her money secrets and answer more of your #BurningMoneyQuestions!