BUILD CREDIT FOR FREE

By simply using your Step Visa Card ̍

STEP USERS IN THEIR

20S IMPROVE THEIR

SCORE BY AN AVERAGE

OF 57 POINTS

20S IMPROVE THEIR

SCORE BY AN AVERAGE

OF 57 POINTS

BUILDING

CREDIT

WITH STEP

IS EASY

CREDIT

WITH STEP

IS EASY

TransUnion research ͆

BETTER CREDIT MATTERS

And saves Step users money where it matters most

| Very Poor 300-600 | |

|---|---|---|

Car Insurance Learn More | $147/mo | $250/mo |

Student Loan Rates Learn More | 6.24% | 10.46% |

Security Deposit Learn More | 6.24% | 10.46% |

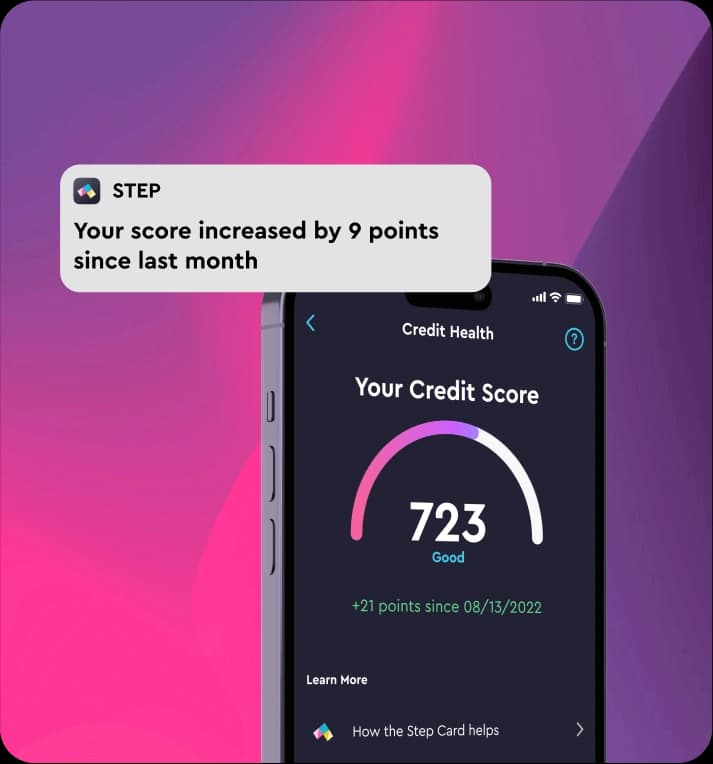

85 points so far

My credit score is constantly increasing, 85 points so far. I love the borrow option.

Brandon T

My credit score is 734

You guys are amazing! My credit score is 734 and I just turned 18 a couple weeks ago! This will be amazing for my student loans. Thanks you!

Michael P.

AMAZED THAT IT WAS SO HIGH

I knew I was building credit but was amazed that it was so high. I have been a Step customer for almost a year and am so grateful to have had the opportunity to build a positive credit history even before turning 18.

Sham K.

Participants may be compensated for their participation. Individual results may vary.

WE KNOW WHAT YOU'RE WONDERING...

How does Step help me build my credit?

How does Step help me build my credit?

Does it cost anything to use credit reporting?

Does it cost anything to use credit reporting?

Is there really no credit score required to get this?

Is there really no credit score required to get this?

How can a good credit score help me?

How can a good credit score help me?

How often is credit reporting updated?

How often is credit reporting updated?

What do you report and to who?

What do you report and to who?

See all FAQs