THE FREE, SAFE, AND EASY WAY TO BUILD CREDIT FOR TEENS

With Step, everyone can earn 3.00% on their savings̾, build positive credit history ̍, and enjoy cashback˖˖ together.

I have a 750 credit score

I downloaded this app when I first turned 14 years old when I got my first job. It is now four years later that I turned 18 years old and I have a 750 credit score. This app is amazing and helped me start so early. I am so thankful thank you Step!

Jayjay9742

84% of 18 - 19 years olds have no credit history. Don’t let your kids be one of them. ͛

My son has had his card since 13

Very awesome family card, I love it and my son has had his card since 13 years old, and had his first job deposit pay to his Step!!!

Cori

Fantastic app

Fantastic app helps me build for my child's future. I add as I go and created a weekly allowance they don't even know I'm doing it but in a few years it will be massive.

John Hubert

START THEIR CREDIT JOURNEY EARLY

Step is the best way for your child to build a positive credit history before they turn 18, without the risk of overspending or missing payments.

| Very Poor 300-600 | |

|---|---|---|

Car Insurance Learn More | $147/mo | $250/mo |

Student Loan Rates Learn More | 6.24% | 10.46% |

Security Deposit Learn More | 6.24% | 10.46% |

TransUnion Research ֕

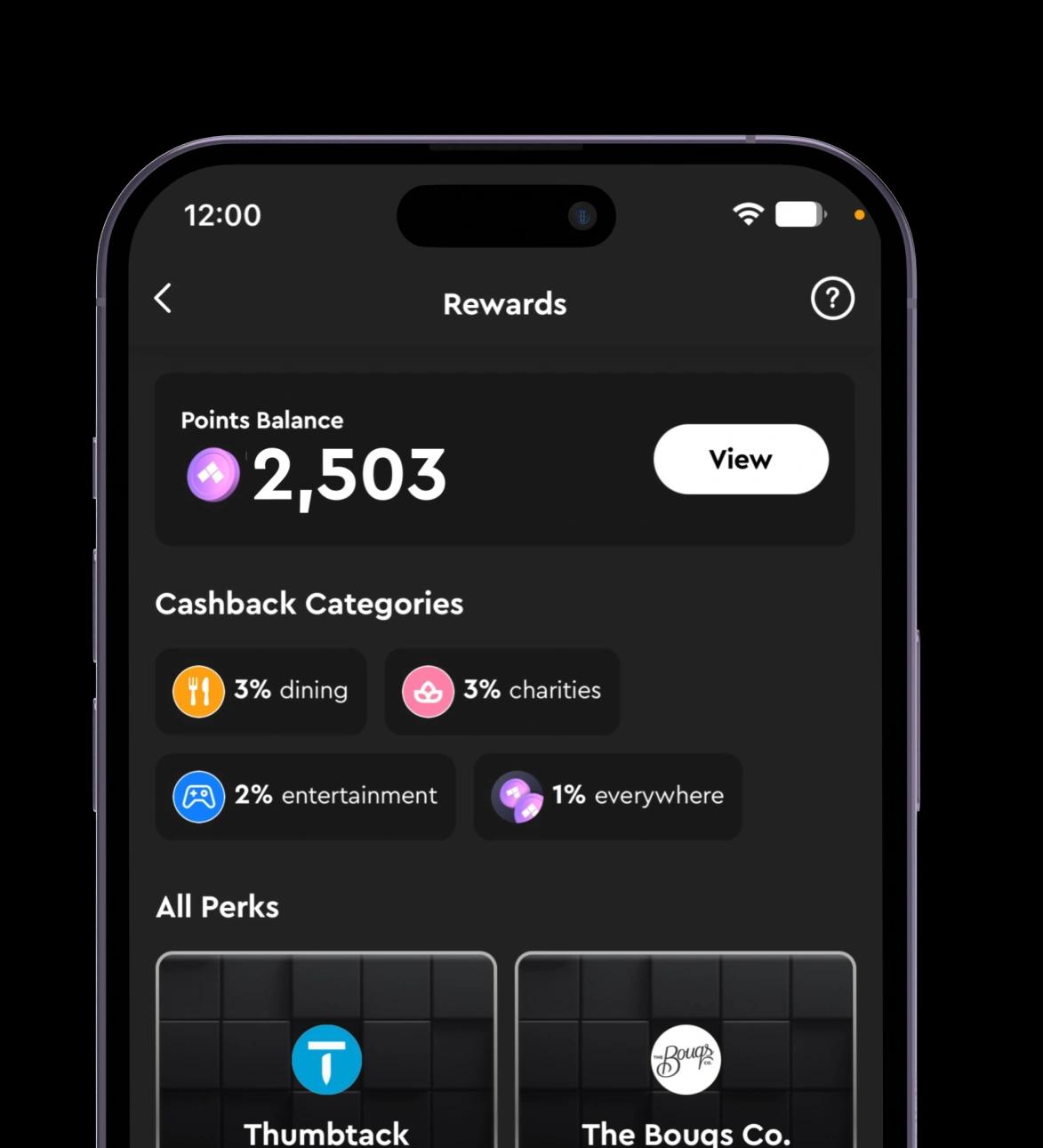

Rewards for healthy habits

The entire family can enjoy up to 10% cashback from select merchants, 1% everywhere else, and $500 in annual credits͑ to help you get more for less.