Money MythBusters: Halloween Edition

It’s officially spooky season! 👻

And, here at Step, we know that money can be the scariest topic of all. In honor of Halloween, we’re channeling our inner Scooby-Doo to find out the truth behind 5 of the most common money myths out there.

Do you dare read on?👇

Myth #1: Carrying a balance on your credit card helps you build a good credit history.

False. This is actually one of the most common money myths. Carrying a balance on your credit card does not help boost your credit score. In fact, it can actually really damage your credit score. Why you ask? Because one of the major components that makes up your credit score is your credit utilization—a number you want to keep below 30%––demonstrating your ability to borrow and pay back money in a timely manner. Each month that you don’t pay off your full balance, you’re being charged additional interest on those purchases, essentially throwing away money that you could put towards so many other things (👀 new Air Jordans).

Myth #2: It’s not worth saving money if you can only put aside a small amount each month.

False. When it comes to saving money, every dollar counts, especially because of something called compound interest. That’s right, banks actually pay YOU to keep your money in a savings account. Here’s how it works: The money you deposit (aka your “principal balance”) will earn a monthly interest amount, and then on top of that, banks usually pay an annual interest rate. So, you’re basically getting free money on top of free money. That’s why saving even a little bit can go a long way, not to mention, it’s a great habit to develop now. Here’s a quick guide to help get you started.

Myth #3: Renting is a total waste of money.

This isn’t always the case.While renting doesn’t help you build equity like owning a home does, there are a ton of costs associated with buying a home like the down payment, interest on your mortgage, property taxes and more. So, depending on your financial situation, it might actually make more sense to continue renting and put some of those cost savings towards paying down debt or investing in the stock market (which are other ways to help you build up your net worth). Renting also provides more flexibility, as should you decide to move, you don’t have to worry about selling your home and hoping to get at least what you paid for it (something that can’t be guaranteed). This is why it's so important to determine your financial goals before purchasing a home, as that might not always be the best way to achieve them.

Myth #4: All debt is bad debt.

Not necessarily. It really depends on what type of debt we’re talking about. Credit card debt for example, which traditionally comes with a very high interest rate, is not good debt because people usually end up spending way more than what they originally borrowed. However, things like student loans and mortgages can actually contribute to your financial future. Let’s take student loans for example: Getting that degree might have cost you $35,000 in debt, but over time, it could pay for itself by increasing your salary potential throughout your career. A home purchase can be similar in this case because you’re making payments towards something you own and could potentially sell for a higher cost in the future (turning a profit). These types of debt also come with low interest rates, but make sure you always shop around for the lowest rate!

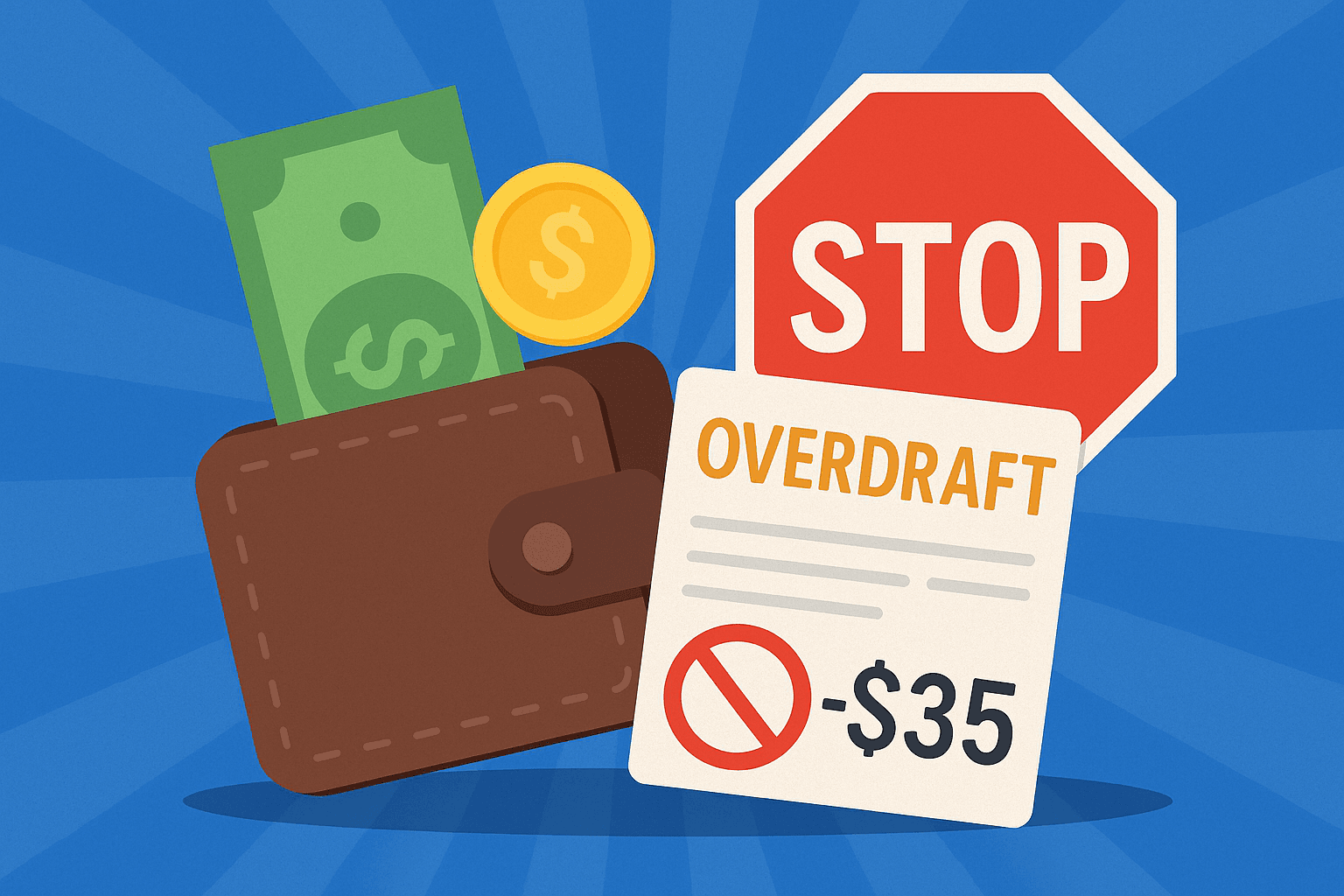

Myth #5: You don’t need an emergency fund if you’ve got credit cards.

False. This one’s so bad I need to say it again: Please do not do this! Credit cards should be used to pay for things that you don’t have the money for short term (i.e., a few weeks), but could pay off by the end of the month when your statement comes. Traditional credit cards make it WAY too easy for you to get into debt and very hard and expensive to get out of. That’s why emergency funds that can cover 3 to 6 months worth of expenses are so important. Anytime you’re a little short on cash, have an unexpected expense or switch jobs, your expenses can be covered without worrying about interest because you’ve already set aside the money. 💪

From all of us at Step, we hope you have a spooktacular Halloween! 🎃