How Step EarlyPay™ Works: The Smarter Way to Get Paid Early

Life doesn’t wait for payday—and now, neither do you. With Step EarlyPay™, you can get cash before payday and take control of your money when it matters most. Nearly 60% of Americans live paycheck to paycheck, and more than 1 in 3 have less than $1,000 saved. That means even small surprises—like breaking your phone or a flat tire—can throw your whole month off.

Step EarlyPay™ gives you a smarter, faster way to access money when you need it. We’ll break down exactly how it works, who it’s for, and how to unlock it in just a few steps.

What Is Step EarlyPay™?

Step EarlyPay™ is a cash advance product that lets eligible users borrow up to $500 instantly—with no interest, no hidden fees, and automatic repayment from your next paycheck or from your Step account.

It’s a flexible, transparent and a smarter alternative to high-interest payday loans or credit cards. Whether you need $20 or the full $500, you decide how much to borrow, so you’re in control every step of the way. Plus, EarlyPay is designed to help build healthy financial habits—not debt.

How to Qualify for EarlyPay

To qualify for EarlyPay, you must:

Be at least 18 years old

Live in the U.S.

Send and receive at least $500 in direct deposits to your Step account within a 31-day period

Once these conditions are met and you’ve received at least one paycheck into your Step account, you’ll automatically unlock access to EarlyPay.

To get started:

Set up direct deposit to your Step account.

Wait for your first paycheck to land.

Once eligible, the EarlyPay™ feature will appear in your Step app

How Borrowing Works

When you're ready to borrow:

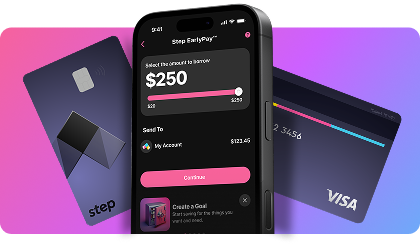

Open the Step app and tap on EarlyPay™

Select the amount you want to borrow—between $20 and $500

Choose your delivery method:

Instant: Money arrives in seconds with a 5% fee (charged at repayment)

Standard: Arrives in about 3 days with no fee

You’re in full control of how much you borrow and when. You can also take out multiple loans during your eligibility period, as long as each one is at least $20 and your total doesn’t exceed $500.

How Repayment Works

Repayment is automatic—no need to set reminders or worry about missing a due date.

Here’s how it works:

Step automatically deducts the amount you borrow from your paycheck (plus any applicable instant transfer fee) from your next paycheck or from your Step account.

If your paycheck is delayed, Step will first try to repay from your Step account balance.

If funds are still owed, any incoming deposits will be used to repay the loan.

There are no late fees and no interest—just clear, upfront terms.

What Makes EarlyPay Different?

Most payday advance services either charge steep fees or hide confusing terms in the fine print.

Here’s why EarlyPay stands out:

0% APR – Never pay interest, ever.

No hidden fees – just choose whether you want to pay an optional 5.5% to access your funds instantly.

Automatic repayment – Makes it easy to stay on track.

Flexible and accessible – Use it when you need it, on your terms.

Safe borrowing – Built-in guardrails to keep you in control.

FAQs

How can I borrow money before payday with Step?

Once you set up direct deposit and meet eligibility, you’ll see the EarlyPay feature inside your Step app. It’s one of the easiest ways to get paid early, with funds available instantly or within a few days—depending on your delivery method

Can I borrow more than once?

Yes! As long as you're eligible, you can borrow multiple times during your pay period, as long as each loan is at least $20 and your total borrowing doesn’t exceed $500.

What if I don’t get paid on time?

Step will first attempt to repay your loan from your Step account balance. If that’s not enough, any incoming deposits will be used to repay your outstanding balance.

Is there a fee?

There’s no interest and no hidden fees. If you choose instant delivery, a 5.5% fee is charged—but only when the loan is repaid. Standard delivery is completely free.

Can I turn off autopay?

Yes. Autopay is enabled by default, but you can contact Step support to disable it and make a manual repayment directly through the app.

Final Thoughts

Step EarlyPay was built to offer a smarter, safer way to borrow—especially for those who may not have access to traditional credit. With no interest, clear terms, and automatic repayment, it’s one of the easiest ways to access up to $500 when you need it most.

Tired of waiting for payday and wondering how to get cash now? Signup for Step, set up direct deposit now, and get access to up to $500 instantly—with no interest, no stress, and total control