5 Reasons Responsible Borrowing Matters (And How to Do It Right)

Borrowing money feels easy until it’s time to pay it back. You tap a few buttons, the cash hits your account, and it feels like a quick fix. But what happens next is what really matters. Responsible borrowing is what keeps short-term help from turning into long-term stress.

Borrowing isn’t something to avoid altogether. It’s a tool, and like any tool, it can help or hurt depending on how you use it. Here’s how to borrow responsibly, protect your credit, and keep your finances on track.

1. Borrowing Isn’t the Problem, Poor Planning Is

Borrowing itself isn’t bad. In fact, it can be smart when you have a plan. A short-term loan or cash advance can help you cover expenses, bridge a paycheck gap, build credit, or handle emergencies. The issue starts when people borrow impulsively or without thinking about repayment.

Before borrowing, take a step back and look at your income and expenses. Ask yourself:

Can I pay this back comfortably once my paycheck hits?

Will this throw off next month’s budget?

If the answer makes you hesitate, it might not be worth it. The smartest borrowers use credit intentionally and know exactly how they’ll repay it.

2. Your Credit Score Tells Your Story

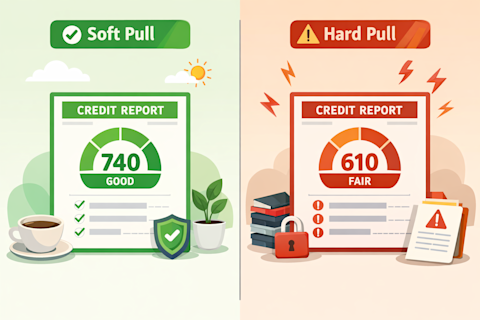

Every time you borrow, you’re building a track record. Lenders look at how you handle money to decide how much to trust you. Paying on time shows responsibility. Missing payments signals risk.

On-time payments make up about 35% of your credit score, which means consistent repayment is the single biggest factor in building strong credit. Missing payments can stay on your report for years and make borrowing more expensive down the line.

A poor credit score can lead to higher interest rates, larger security deposits, and fewer loan approvals. It can even affect job opportunities since some employers check credit reports during the hiring process.

If you want to see how credit scores really work, check out understanding credit scores.

3. Borrowing Without a Plan Leads to Stress

Many people borrow first and figure out repayment later. That’s what causes financial stress. Responsible borrowing starts before you even hit “accept.”

Think about what you’re borrowing for and how soon you can repay it. If you’re borrowing often just to cover everyday expenses, it might be time to adjust your budget. Credit should support your finances, not carry them.

If you’ve ever taken a loan to pay off another loan, you know how quickly that cycle can spiral. It’s better to borrow less, pay it back on time, and keep your balance manageable.

4. Smart Borrowing Builds Opportunity

When you manage credit responsibly, you unlock better financial options like lower loan rates, higher limits, and better insurance rates. It also gives you flexibility in emergencies.

Tools like Step EarlyPay can help by giving you short-term access to cash with no interest or hidden fees. It’s a useful option when used with a plan, not a habit. Borrow only what you need, repay on time, and you’ll avoid the stress that comes from relying too heavily on borrowed money.

Here’s what smart borrowing often looks like:

You borrow money for things that you need (not just want.)

You set reminders or automate repayments to make sure you repay on time.

You think about next month, not just today.

5. Consistency Builds Confidence and Credit

Consistency pays off. Borrowing should move you forward, not hold you back. The key is to borrow with purpose, repay on time, and understand how credit fits into your bigger picture. Whether it’s a credit card, a loan, or something like Step EarlyPay, using these tools responsibly helps you build stability and financial freedom. Borrow smart, pay it back, and let your good habits do the work. 💪