Common Credit Mistakes Young Adults Can Avoid in 2026 💳

Just got your first credit card? Or thinking about it? You’ve probably heard “just use it responsibly.” But what does that even mean?

The truth is, credit is easy to mess up. One missed payment, one maxed-out card, and suddenly your score tanks. The good news? Most of these mistakes are avoidable once you know what to look for.

Let’s walk through the most common credit mistakes, how to avoid them, and what to do if you’ve already slipped up.

Why Credit Trips Up So Many Young Adults (And Why It’s Not Your Fault)

Nobody teaches this in school. You turn 18, maybe get your first card, and boom you’re expected to understand how credit scores work.

Add in the internet’s endless mix of myths and hot takes, and you’re left guessing what’s real. It’s not about being irresponsible. It’s about not having a roadmap. Let’s fix that.

The Most Common Credit Mistakes (and How to Dodge Them)

1. Missing or Late Payments

This one’s brutal. Your payment history makes up 35% of your score. Even one missed payment can stick around for years. The fix? Set up autopay, even if it’s just the minimum, and add calendar reminders so you’re never caught off guard.

2. Maxing Out Your Card

High balances signal risk. Even if you pay off your full balance, maxing out your card can drag your score down. A good rule of thumb is to stay under 30% of your limit. So if your card has a $500 limit, try not to carry more than around $150 at any time.

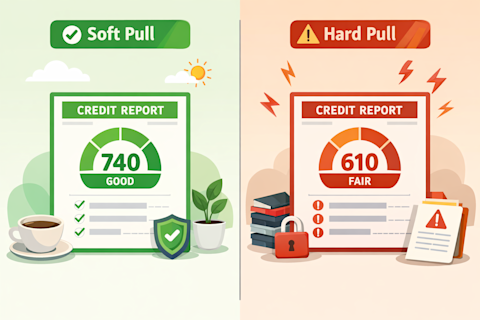

3. Opening Too Many Cards at Once

Slow down. Every new application triggers a hard inquiry on your credit report. One or two is fine, but if you apply for five cards in a month, it looks like you’re desperate for credit. Space out applications and use pre-qualification tools when possible.

4. Only Paying the Minimum

This keeps you out of trouble but racks up interest. If you only pay the minimum, you’ll end up spending way more than you borrowed. Try to pay the full statement balance each month, or at least more than the minimum to chip away at your balance faster.

5. Closing Old Cards

Age matters. The longer your credit history, the better your score. So even if you don’t use an older card often, keeping it open especially if there’s no annual fee helps your credit profile stay strong. Need help making sense of it all? Here’s a guide to understanding credit scores that breaks it down simply.

Already Messed Up? Here’s How to Fix It 🛠️

It’s okay. Most people don’t get this right the first time. The key is to start making all your payments on time and pay down your balances to lower your credit utilization.

If your score took a hit, consider using a secured credit card to build credit. These cards are easier to qualify for and report to the credit bureaus, meaning you’ll start rebuilding your score faster. With consistent use, you’ll see real improvement within 6 to 12 months.

How to Actually Use a Credit Card the Right Way ✅

Use it, but don’t abuse it. Credit cards are powerful tools when used well. That means:

Pay your balance in full every month.

Stay under 30 percent of your credit limit.

Use your card regularly, but don’t treat it like free money.

Don’t chase points or rewards if it means overspending.

Do that consistently and your credit will quietly improve in the background.

How Step Helps You Avoid These Mistakes

Step is built for people who are new to credit or trying to rebuild it.

Here’s how it helps:

A no-interest, no hidden fee secured credit cardthat reports to the credit bureaus.

No hard credit checks to get started

Smart tools like EarlyPay (borrow up to $500) and Step Earn (make money doing simple tasks)

Built-in features to help track your score and spending in one place

The result? The average Step user has a 721 credit score by age 18. That’s higher than many adults.

Avoid Credit Mistakes Start Building Smart with Step 👣

You don’t have to be perfect. You just have to be consistent. Avoid the common credit traps, take small steps to improve your score, and use tools that help you build without stress. Sign up for Step in under 2 minutes and start improving your credit today.

FAQs: Credit Mistakes & Misconceptions

Does applying for a credit card hurt my score? Yes, but only a little and temporarily. A hard inquiry might drop your score by 5 to 10 points, according to Experian. It usually rebounds in a few months.

Should I keep an unused card open? Most of the time, yes, unless there’s a high annual fee. It helps with credit age and utilization. Make sure to use it every now and then to make sure it doesn't get closed!

How many cards should I have? Start with one. Add more only if you need them and can manage them.

What if I’ve already messed up my credit? You’re not alone. Start paying on time, lower your balances, and consider using a credit building app to get back on track. Change doesn’t happen overnight, but with a few solid habits, your score will start to move in the right direction.