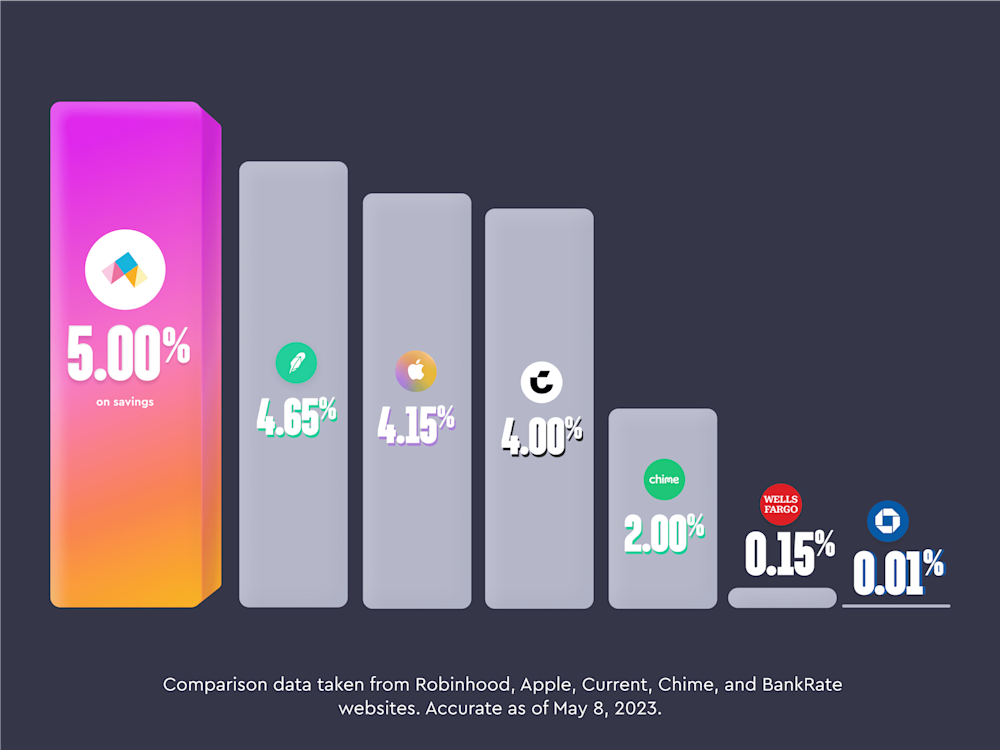

Step users can earn 5.00% on their savings by setting up a monthly qualifying direct deposit. There are no monthly fees and no minimum balance requirements. Plus, unlike many high-yield savings accounts and certificates of deposits on the market, there are no limits on how often or when people can access their money. Users can automatically round up their purchases to the nearest dollar and add the change to their savings, earning 5.00% on every dollar they save.

In addition to this savings offer, Step also unveiled an elevated rewards program. Customers who qualify to earn 5.00% on their savings will also earn 3x points on purchases at select merchants, 2x points on restaurant dining, food delivery, and charitable donations, and 1x points on entertainment, streaming, and gaming, helping them get more out of their everyday spending.

These best-in-class benefits complement Step’s existing credit history building, banking, and investing tools already provided to over 4 million account holders who are using the platform to build a bright, and responsible, financial future.

1: Your Step deposit account is not an interest bearing product. The savings percentage is not interest, but instead earned as cash rewards directly funded and managed by Step. The rewards, if calculated as an APY, would be 5.00%. This percentage is variable and may change over time. To qualify, a minimum direct deposit of $500 or more from a payroll provider or employer within each 30 day period is required. We may offer promotions for new or existing customers from time to time.

2: Accurate at the time of publication. The national average rate referenced is from FDIC's published national average savings rate, accurate as of May 15, 2023. See the FDIC website for more information: https://www.fdic.gov/resources/bankers/national-rates

3:https://www.cnbc.com/2023/04/03/3-ways-to-make-sure-youre-earning-competitive-interest-on-your-cash.html

About Step

Step was founded by financial industry veterans CJ MacDonald and Alexey Kalinichenko to provide teens, their families and young adults with financial tools for today’s modern-day banking needs and to promote financial literacy for the future. The founding team has 50+ years of combined financial technology experience from companies like Affirm, Block, Google, Gyft, Stripe, and Meta. The Series C company has more than 4 million customer accounts and has raised more than $500 million in funding, backed by Coatue, Crosslink Capital, General Catalyst, Stripe and several other prominent investors. Evolve Bank & Trust, Member FDIC provides Step’s banking services and issues the Step Visa Card pursuant to a license from Visa U.S.A. Inc. Securities (stock and ETF) services powered by and securities assets custodied by Drivewealth, LLC. To learn more, please visit: www.step.com or contact press@step.com.