Hard Pull vs Soft Pull: What Actually Happens When You Check Your Credit 🔍

You've probably heard that checking your credit score can hurt it. But then you open your Step app and see your score right there, updated daily. Wait, what? If checking your credit is so bad, why can you do it anytime you want?

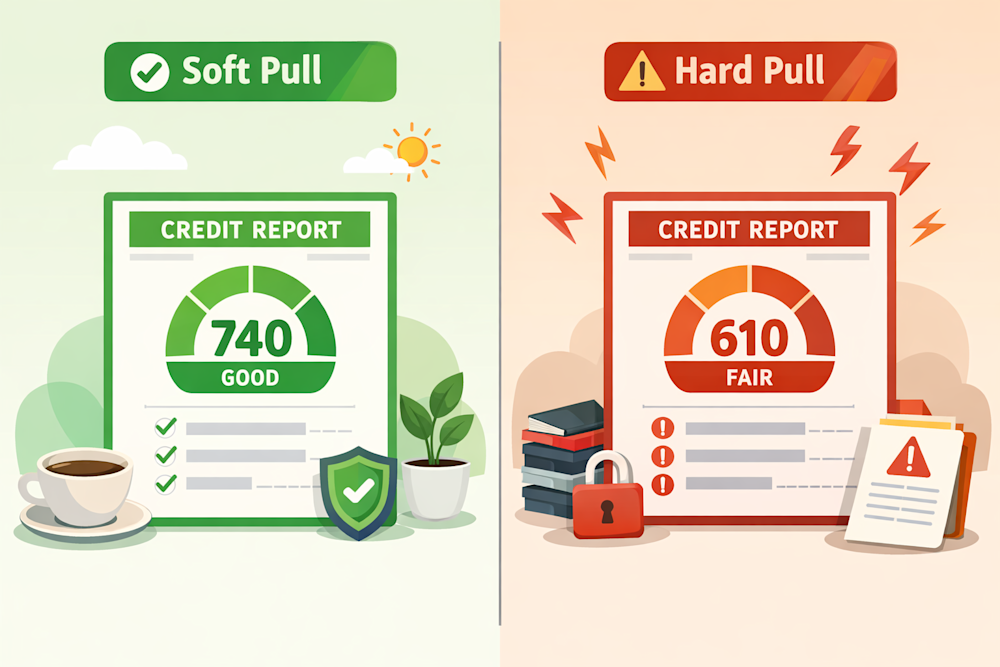

Here's what's actually going on: the difference between a hard pull vs soft pull changes everything. One type of credit check is completely harmless. The other can drop your score by a few points and stick around on your report for two years. And if you don't know which is which, you might be tanking your credit without even realizing it.

Let's break down exactly what happens during each type of credit check, when they show up, and how to avoid getting dinged when you don't need to be.

What Is a Soft Credit Pull?

A soft credit pull (or soft inquiry) happens when someone checks your credit, but you're not applying for new credit. The big deal here? Soft pulls don't affect your credit score at all. You can have as many as you want.

Here's when soft pulls happen:

You check your own score in the Step app

A company sends you a pre-approved credit card offer

An employer runs a background check

A landlord screens you before approving your lease

You're exploring credit options but haven't officially applied yet

Soft pulls are just for informational purposes. No one's making a lending decision yet, so there's zero risk to your score. That's why you can open your Step app every single day and check your credit without worrying.

What Is a Hard Credit Pull?

A hard credit pull (or hard inquiry) is totally different. This happens when a lender checks your credit because you've officially applied for a loan or credit card. And unlike soft pulls, hard pulls can lower your credit score by around 3 to 5 points each and stay on your credit report for up to two years.

Hard pulls show up when you apply for:

Most traditional credit cards

A car loan or lease

A mortgage or personal loan

Some cell phone plans or utility accounts

You have to give permission before a lender can do a hard pull. That usually means signing paperwork or clicking "I agree" on an application. If you didn't authorize it, it shouldn't be there.

The reason hard pulls matter is because lenders see them as a sign you're actively taking on new debt. One or two a year? No big deal. But multiple inquiries in a short time makes you look desperate for money, and that's a red flag.

Real Example: Applying for Multiple Cards

Let's say you apply to three different credit cards within a week to see which one approves you. That's three separate hard credit pulls. Even if you only accept one card, all three inquiries stay on your report, and your score could drop 10 to 15 points total.

Smarter move? Use pre-qualification tools (which only do soft pulls) to see which cards you're likely to get approved for before you officially apply. Then submit just one application. One hard pull instead of three.

How to Avoid Unnecessary Hard Pulls

Don't apply for credit you don't actually need. That store card offering 20% off? Not worth it if you're never shopping there again.

Ask before you apply. If you're not sure whether it's a hard or soft pull, literally just ask the company directly.

Check your credit regularly with the Step app. It only does soft pulls, so you can monitor without risk.

Be strategic about timing. If you're applying for a car or apartment soon, hold off on new credit cards for a month or two.

💡 Pro tip: Some landlords use tenant screening services that do soft pulls first. Always worth asking.

FAQ: Hard Pull vs Soft Pull

Does checking my own credit count as a hard pull? Nope. Checking your own credit is always a soft pull. Check as often as you want.

How many hard pulls is too many? Lenders get nervous if they see more than 2 or 3 in a short period. Space out applications by a few months.

Will one hard pull ruin my credit? Not even close. Most people see a small drop that recovers within a few months if you're managing credit well.

Stop Stressing About Hard Pulls and Start Building Credit 💳

Now you know the real difference between a hard pull and soft pull. If you're just starting out, one or two inquiries a year won't hold you back. Just be intentional. Apply for credit you actually need, use pre-qualification tools when you can, and keep making your payments on time.

Ready to start building real credit? Use a credit building app like Step to track your progress.

Your future self will thank you. 🙌